Preface

The statistic that the cost of a new client acquisition is at least 5 times greater than retaining existing clients is well-known.

Customer loyalty and retention in the B-2-C business sphere has assumed scientific attributes and complexities with real-time experience capture, analytics-enabled behavioural insights and holistic experience-measurement metrics such as NPS (Net Promoter Score®) that span and impact horizontally across the enterprise.

In the B-2-B space however the customer relationship orientation is relatively more vertical and limited primarily to Sales-Production/Delivery-Support functions. While the vertical orientation facilitates deeper understanding of a specific client’s needs and objectives it also poses totally different relationship management challenges in terms of effective response to all client touch-points, business retention and future growth. This White Paper attempts to address some of the issues that impact effective management of strategic client relationships, since for most B-2-B enterprises strategic clients constitute a significant proportion of annual revenues.

Perspective

The fact that all Clients are not equal is universally accepted in private and vehemently denied in public by most organizations.

Consequently, internally, most companies tend to categorise their Clients into a range of base metals such as Platinum, Gold, and Silver etc – and often tell most clients that they are a treasured Platinum account. Usually the real Platinum Clients are considered to be of strategic value – i.e. High Value (Billing + Referenceability)

Detailed definitions and complex relationship management frameworks for each Client category are readily available and are often adopted and rolled-out with great initial enthusiasm and even greater expectations – i.e.,

- Strategic Clients will now be easier to win

- Strategic Clients will now be easier to retain

- Strategic Clients will now continuously increase their business with us

The fact then that most such programmes fail to live up to their billing is somewhat unfortunate, but not exactly unexpected.

Prognosis

The prime reasons for failures of many strategic client account relationship management (SCRAM ) programmes – or at least not meeting the exacting expectations of the CEO – essentially derives from an inadequate appreciation of the organizational focus, effort and consistent management commitment required to ensure sustained business growth.

In many organizations SCRAM is perceived as nothing more than a more complex and data-intensive Account Management process.

And that perception is often the root of the problem since it fosters the belief that functions apart from Sales-Production/Delivery-Support have very little to do with strategic client relationships on an on-going basis.

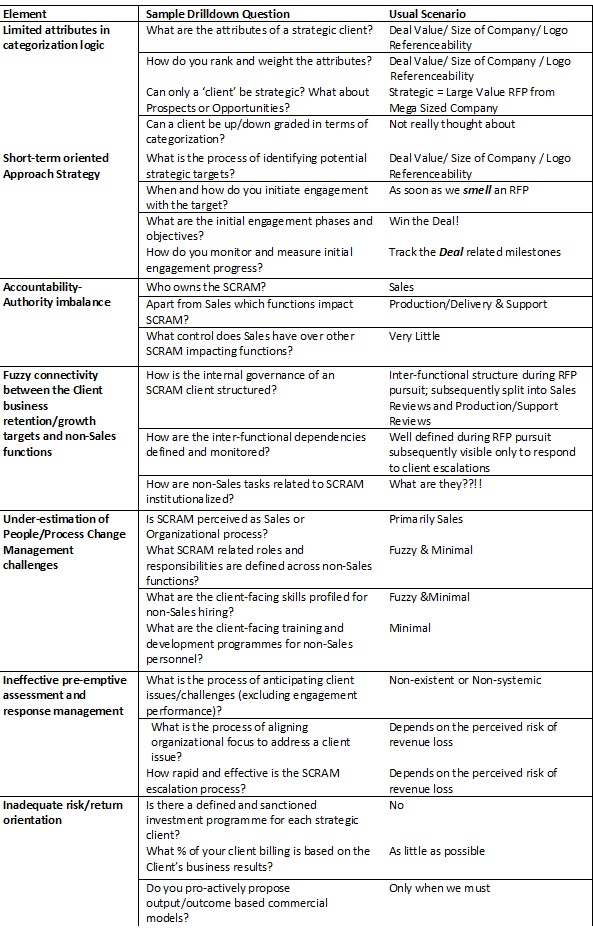

An absolutely necessary condition for effective strategic client relationship management is the alignment of the entire organization to the objectives of the SCRAM process. In order to construct a logical SCRAM framework, 7 elements have been defined with a few drilldown questions and the usual responses.

Assessing the SCRAM Framework

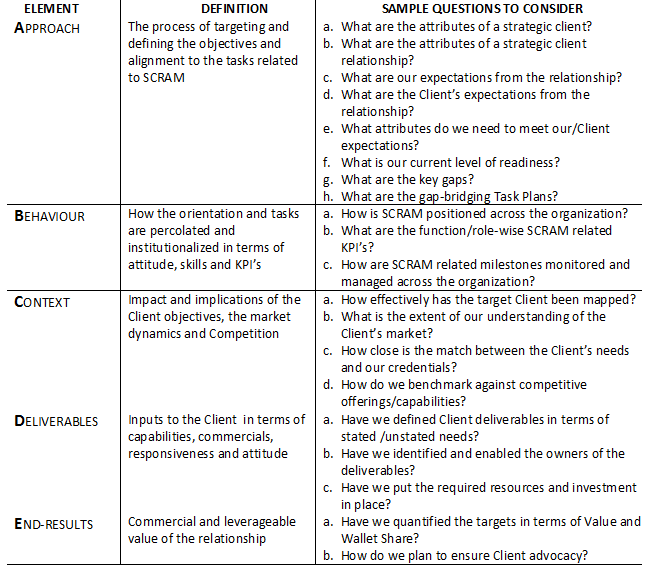

Configuring the ABCDE of SCRAM

The table below provides an indicative guideline that may help you in shaping an effective SCRAM framework and process

Postscript

More and more prospective clients are asking pointed questions about relationship and engagement governance. Most sell-side organizations have well-defined and relatively efficient engagement governance structure focused on product/service delivery. However when it comes to effective relationship management the track-record is patchy and inconsistent. There is an old saying ‘that for the want of a nail a kingdom was lost’.

Strategic client relationships need to be managed in terms of breadth, depth and detail so that no ‘nail’ should ever be missing.

A Few Questions to Think Over……..

If you found this White Paper relevant then the following questions may trigger some constructive internal discussions:

1. Are you satisfied with the relationship with your top 5 clients?

2. For your top 5 clients have you gained or lost client wallet-share over the past 3 years?

3. Have the year-on-year growth in the billing of your top 5 clients exceeded your expectations?

4. Is the top 5 average client growth rate higher or lower than your overall business growth?

5. Is your top management formally tasked (in terms of KPIs) on SCRAM performance?

We will be happy to collaborate and contribute in any way you consider appropriate.

Drop me a LinkedIn InMail or Tweet me @hclsumit or comment.